Mobile Payments War: Apple Pay Winning Over Consumers

| David Curry | | Nov 02, 2014 10:28 AM EST |

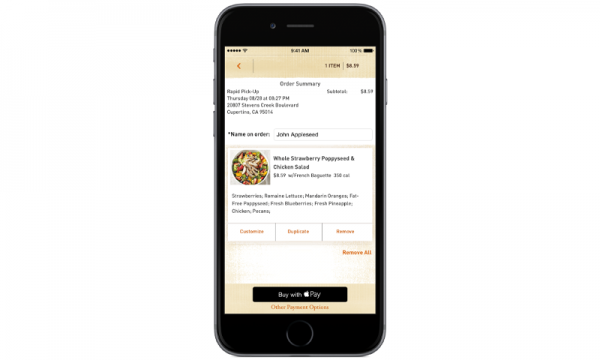

(Photo : Apple) MCX has not even started the rollout of CurrentC - set for launch in 2015 - but already consumers are turning against the QR based payment service in favor of Apple Pay and other NFC solutions.

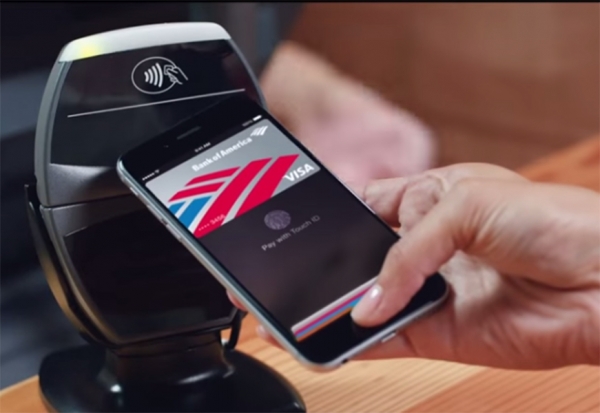

The war on mobile payments is starting to heat up, with the consortium of more than 50 retailers backing MCX's CurrentC facing criticism on all sides for supporting an outdated system that has not even arrived yet.

CurrentC works by scanning a QR code to pay for goods. The app takes a chunk of information about users and what they buy, in order to offer real-time loyalty points for cheaper deals the next time they shop.

Like Us on Facebook

It also has no charge for using the service, unlike credit cards and NFC payment services. This is one of the major reasons CurrentC is supported by Best Buy, Walmart, Target and other large retailers, due to the zero charge they would normally face with credit cards.

Even Walmart's CEO Lee Scott isn't sure if it will succeed, saying at a conference "I don't know that it will, and I don't care. As long as Visa suffers."

The problem for Walmart (and many others) is CurrentC will not succeed - at least not in its current form. Testers claim the service is slow and QR codes are unreliable, compared to other mobile payment services that use NFC or WiFi to connect the consumer to the cashier.

This basically puts all of the retailers supporting CurrentC back in the same position, accepting credit cards, but not accepting NFC payments. This could hurt them in the long run, especially if retailers who do accept NFC payments promote this feature in and out of stores.

Apple Pay already has 1 million registered credit cards, all it needs is for major retailers to accept the NFC payment. By the time CurrentC roles out, analysts forecast up to 8 million U.S. consumers will actively use Apple Pay where possible.

The perfect example of why CurrentC will fail can be seen on carrier payment system, called SoftCard, previously named ISIS. This payment service has been backed by T-Mobile, AT&T, Verizon Wireless, and it still has no market penetration, even after the carriers removed Google Wallet's functionality.

No matter how much the retailers and big companies push their own service, if it is unreliable, it will not work, especially when Apple Pay is the competitor.

©2015 Chinatopix All rights reserved. Do not reproduce without permission

Retailers Blocking Apple Pay Due To MCX Contracts

Retailers Blocking Apple Pay Due To MCX Contracts Exec Claims Apple Watch will be 'Huge'

Exec Claims Apple Watch will be 'Huge' Apple CEO Tim Cook Eyes Partnership With Alibaba In China

Apple CEO Tim Cook Eyes Partnership With Alibaba In China CurrentC vs Apple Pay War Looms as Merchants Reject New Electronic Payment Service

CurrentC vs Apple Pay War Looms as Merchants Reject New Electronic Payment Service Apple, Android Fans To Boycott Retailers Blocking Apple Pay

Apple, Android Fans To Boycott Retailers Blocking Apple Pay U.S. Pharma Chains CVS and Rite Aid Reject Apple Pay

U.S. Pharma Chains CVS and Rite Aid Reject Apple Pay

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?