China Railway Signal Debuts on Hong Kong Stock Exchange After HK$10.8 Billion IPO

| Kwao Peppeh | | Aug 07, 2015 03:05 AM EDT |

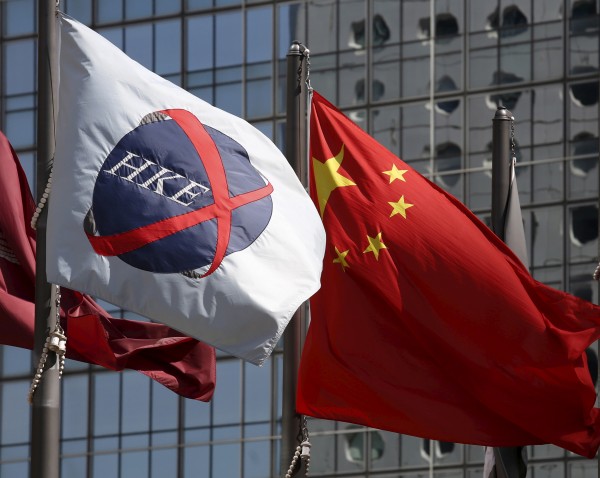

(Photo : REUTERS/Bobby Yip) China Railway Signal has made its trading debut today in the Hong Kong Stock Exchange on Friday. The company raised HK$11 billion ($1.4 billion) in an initial public offering for the move.

China Railway Signal & Communication Corporation (CRSCC) became the latest mainland company to appear in the Hong Kong Stock Exchange as it made its trading debut on Friday.

CRSCC shares opened flat at the beginning of trading on Friday. However, by mid-morning it was trading at HK$6.32 - rising as high as HK$6.38. At midday, CRSCC shares closed at HK$6.30. The Hang Seng Index (HIS) rose by up to 0.9 percent in trading on Friday.

Like Us on Facebook

CRSCC successfully raised about HK$10.8 billion (USD$1.4 billion) to make its appearance on the Hong Kong Stock Exchange. The company sold 1.75 billion shares at about HK$6.30 to HK$8 per share. Over a dozen cornerstone investors purchased more than half of the shares on offer. In total, CRSCC sold up to 68.3 percent of its shares on offer.

CRSCC's HK$10.8 billion (USD$1.4 billion) initial public offering (IPO) is the fourth highest in Hong Kong this year. The IPO of the state-owned provider of railway control systems is the first major listing in the Hong Kong stock market since the recent market rout in China.

In mid-June, China's stock market experienced a three-week-long plunge, resulting in a loss of about USD$3 trillion. Authorities were forced to implement several strict measures to reverse the tide, including suspending all IPOs and preventing major companies from selling their shares. China's stock market has not recovered from this and experts say it continues to be shaky. Last week, Chinese shares experienced their biggest loss in a single day since 2007 after the release of data showing that profits from the country's industrial sector has dropped slightly.

According to its IPO, CRSCC is valued at about HK55.1 billion (USD$7.11 billion). Experts say the fact that CRSCC shares were priced relatively low during its IPO could be related to the losses in China's stock market. It is unclear when China Securities Regulatory Commission (CSRC) will lift the suspension on IPOs in the mainland.

Analysts say Chinese companies may opt to get listed in the Hong Kong Stock Exchange while the stock market remains unstable in the mainland. The head of Hong Kong Stock Exchange Charles Li, shares the same opinion. "We will continue to see new flows coming in - not only the ones that wanted to be here in the first place. We probably will be seeing more, other companies that are making a decision that are not able to alternatively switch," he told reporters recently.

TagsChina Railway Signal & Communication Corporation (CRSCC), CRSCC HKEx, China Railway Signal $10.8 Billion IPO, China Signal Railway Hong Kong Stock Exchange Debut

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?