Nikkei Bounces As Market Awaits Word On Vote, Tax; Sony Soars On Revenue Plan

| Christian George Acevedo | | Nov 19, 2014 09:30 PM EST |

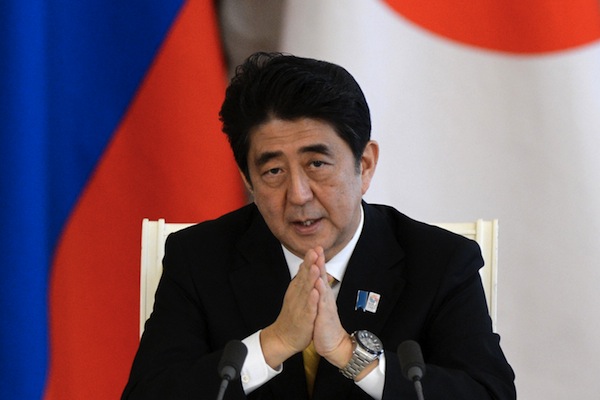

(Photo : Reuters) Japanese Prime Minister Shinzo Abe

Japan's stock market made a rapid rebound Tuesday morning as investors wait for Prime Minister Shinzo Abe's announcement for a snap election, a report from Reuters revealed.

"The Japanese market had risen sharply so yesterday's shock caused volatility," Isa Kubo, equity strategist at Nissay Asset Management, said. "The market's focus now is whether Abe can continue to draw support from voters, and what kind of measure she will announce."

Like Us on Facebook

Meanwhile, Sony made an astonishing bounce after its stock price soared 5.8 percent to 2,464.5 yen. This was Sony's highest since April 2011. The gain came after the company announced that its plans to increase revenue by up to US$11 bn through its movie arm in the next three years.

Meanwhile, the morning session in the Nikkei benchmark ended with 1.7 percent gain to reach 17,258.97. Nikkei went down 3.0 percent to 16,973.80 on Monday, its lowest since November 10, after it was announced that Japan is headed to recession.

The Bank of Japan purchased 38 billion yen worth of exchange-traded funds (ETFs) and another 1.2 billion yen of Japanese real estate investment trusts (J-REITs) as a means of boosting the nation's economic stimulus package.

Prime Minister Abe is slated to announce his plans to postpone the implementation of the 10 percent tax hike, as well as call for a snap election in the lower house. The poll is expected to take place December 14.

Economists and analysts were surprised after the government announced that Japan has slipped into recession in the third quarter.

It is believed that the contraction of the economy is triggered worries over the impending national sales tax hike, which took a hit on consumer spending. But there were also those who saw the silver lining.

Tomo Kinoshita, chief Japan economist at Nomura Securities wrote in a report that consumer spending gradually bounced back in August and September this year.

He also explained that delaying the consumption tax increase and a weakened currency could also affect the economy in a positive manner.

Tagsnikkei, Japan stock market, snap election, sony, Japan Economy

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?