China's Mutual Funds Industry Is Back On Track

| Dino Lirios | | Mar 30, 2015 02:51 AM EDT |

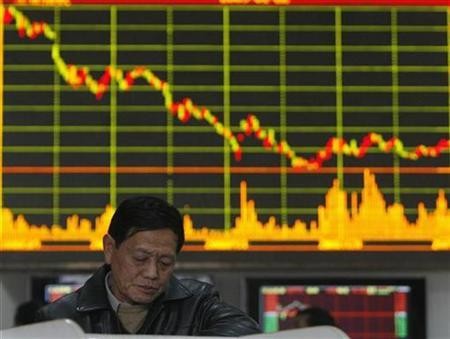

(Photo : REUTERS/ALY SONG) China Stocks

China's mutual fund industry rebounds as investors cash in on the country's soaring equities market, with new funds being quickly finished by investors who once spurned the stock market's "too high risk."

Investors had shied away from stocks since the financial crisis in 2007. The rebound is seen as a successful venture of policymakers who had been trying to build investor confidence in equities. The new demand would pressure China to prevent this fresh rally from imploding.

Like Us on Facebook

In the first two months of the year, about 75 funds, composed of mainly equity and balanced funds with both equities and bonds, were issued. This raised CNY110 billion (US$17.7 billion), according to Z-Ben Advisors, a Shanghai-based fund consultancy firm.

More than half, at around 35 funds, accumulating less than CNY50 billion were created in 2014.

Market gains of over 50 percent in 2014 and 13 percent this year have rekindled interests for mutual funds.

"People are rushing into mutual funds because many think it's just the beginning of an unprecedented bull market," remarks Mark Zeng, analyst at Howbuy Wealth Management, a consultancy firm that assists mutual fund companies sell products.

The risk of investing in stocks has shrunk on the back of anticipated monetary easing in the near term, accompanied by more reforms to state enterprises, and a wealth shift from real estate to stocks, notes Brokerage Shenwan Hongyuan.

Shenwan Hongyuan forecasts the Shanghai Stock Exchange Composite Index hitting the 4,500 mark this year, 22 percent higher than last Friday's close of 3,691.10.

"The worst time for China's stock market is over, and there's high probability that the market will continue to rise," mulls Pan, a mid-40year old Shanghai office manager.

Pan and other investors and managers are taking cues from the government, believing authorities are okay with the current rally. Less has been heard about share bubbles, and more about incoming and growing liquidity improve investor sentiment.

Tagsmutual funds

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?