Italian Court to Hear Multi Billion Euro Laundering Case Involving Bank of China

| Benjie Batanes | | Aug 06, 2015 04:13 PM EDT |

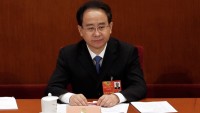

(Photo : Getty Images/China Photos) Italian authorities say millions of Euros have been laundered through the Bank of China's representative office in Milan.

A court in Florence, Italy, is set to hear a case against the Bank of China in March next year. China's central bank has been accused of conniving with hundreds of individuals to smuggle more than 4 billion Euros out of Italy through a partly owned Chinese cash transfer firm.

Like Us on Facebook

ABC News reported that the announcement was made on Wednesday by Florence assistant prosecutor Giulio Monferini.

Italian authorities believe the money was laundered through the Bank of China's representative office in Milan. Prosecutors estimate that around four bank employees were involved in the scheme and that their branch was able to collect almost 800,000 Euros for processing the cash transfer.

The Bank of China has since dismissed the allegations and promised to fully comply with any requests that may come from the Italian government. Defense attorneys for the cash transfer firm maintain that the owners are innocent of the charges.

Chinese authorities promised to implement financial controls that will help prevent, if not minimize, instances of money laundering as soon as news of the involvement of a Chinese bank in the Italian case was made public.

Chinese immigrants in various countries largely send cash to their relatives in China through an informal transfer system. Such methods are largely unregulated by host countries like Italy until the amount becomes too big to ignore. China and other countries must now implement new rules to regulate the flourishing trade.

Italian authorities believe that a cash transfer firm called Money2Money used criminal-like tactics in order to corner the market. The Bank of China in Milan agreed to only cater to cash transfers made by Money2Money.

Italian prosecutors believe a large percentage of the money transferred by the firm came from criminal activities. The bank would have had a problem detecting any illegal activities since the launders transferred the cash in amounts in order not to raise suspicion.

Italian prosecutors were having a hard time locating many of the individual suspects, mostly Chinese immigrants. But the authorities have managed to track and inform a majority of them about the charges leveled against them.

Meanwhile, American federal regulators have also advised another Chinese bank to improve its method of catching clients suspected of engaging in money laundering activities.

TagsBank of China, Money2Money, Chinese immigrants in Italy money laundering, Bank of China Milan Money Laundering, euro laundering, China Online Money Transfer, giulio moferini, italian prosecutors, anti-money laundering

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?